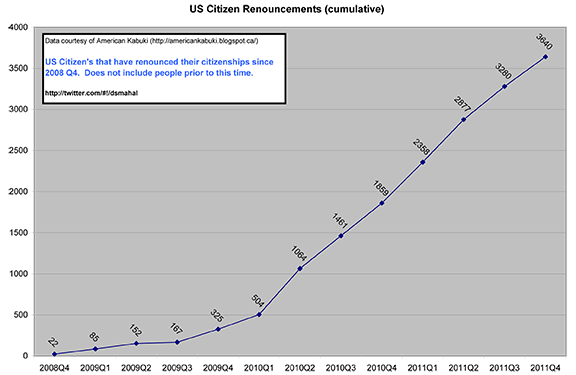

The following data I pulled from reports posted in the Federal Register by the IRS. All of this information is public domain and openly available. The IRS is required to post the names of people by quarter of those who have renounced their US Citizenship and become expatriates no longer subject to US laws.

Graphs of American Kabuki data courtesy Dalip S. Mahal: Twitter: @dsmahal

There's a few reasons why people do this, one is quite organic, say someone marries a foreigner, moves to their country and that country requires renouncing prior citizenship before granting citizenship. Fair enough.You sometimes hear of Hollywood celebrities who get angry about a US policy and threaten to leave the country, but the seldom do it. Its just too hard to work in Hollywood with out a US Passport and citizenship.

Many countries allow dual citizenship, The US, Canada, Australia, Britain and other European countries allow dual nationals. For example, a number of US - Israeli dual nationals have served in various White House administrations. Some people have more that two passports. The merits of this policy are dubious. Because dual citizenship is allowed its extremely rare people renounce it.

Avoiding US taxes on wealth stashed abroad.

There's a catch-22 with having US citizenship, if you go overseas to work, the IRS claims the right to your income anywhere in the world. I experienced this 20+ years ago while working in England I had to file tax returns in both countries, and had to factor in about $2000 each year to have a big name accounting firm do all the specifics of the filings. I didn't like it but hey, its the rules. Not much I could do about it.

The way it works the IRS claims your money as being taxable even when the US government is not providing any services to US citizens working overseas. In fact the government basically abandons you once you leave the country, other countries take far better care of their expatriated workers than the USA does.

This tax policy also puts US contract workers at a disadvantage to their European or Australian counterparts. In those countries when you leave the country and relocate your current income tax liability stops (except for any back taxes you owe). In Europe (at least 20 years ago, things might be different now) if you only worked 6 months in a country you didn't even enter the tax system, stay longer than 6 months you become part of the tax system. Six months or less you were considered on "holiday". This is how the wealthy of Europe avoid taxes, they move from home to home as seasons change and are "perpetual tourists". This is something the common man in Europe cannot do. The rich get richer as they say. I think this is also why BRICs countries so easily became part of the European Union, they are warm places for wealthy Europeans to spend the cold European winters. Perpetual tourists that they are. One set of rules for them and another set for everyone else.

I knew British contractors who would work a contract for 6 months and then move on to another European country and never have to pay taxes to any government. If you know and follow the rules its legal, but not for Americans. Americans have to report their tax income to BOTH countries. If you work in England you pay taxes to UK Inland Revenue (they tell you what you pay from each paycheck and it changes every year). This tax paid the UK is mitigated through a bi-lateral tax treaty (the treaties vary with every country and you have to be careful). The USA then allows you a foreign tax credit against your USA taxes - so the net result is a wash - you don't owe any US taxes because you paid British taxes - and the only one getting richer is tax accountants. Kind of a waste of time and money for all concerned but that's the IRS rules.

There is one huge reason why people would renounce their US Citizenship. Avoiding US taxes on wealth stashed abroad. I never had any wealth so not exactly a worry of mine. I'm just the kid of a working class man. The IRS has been playing hard ball with Switzerland about the famous Swiss secret banking. The Swiss value privacy a great deal. We should too when it comes to personal privacy. When a Swiss gets a telephone bill, the numbers called will have the last 4 digits blacked out. That is done so nosy telephone employees or mailmen can't snoop on who you call. Its well known that women in the US who have access to credit files sometimes scan credit bureaus for the credit records of men they want to date to determine their financial status. The Swiss try to put a stop to that kind of nosy self-interest. Rifle through the trash you won't get the information either - its not on the bills. Actually admirable I think. Privacy is good.

Swiss banks have strict rules on disclosing business and personal money transactions. If a Swiss bank teller discloses who a company uses for a supplier, the teller gets a $50,000 fine. That kind of competitive information should be kept quiet and I believe this is why Switzerland has had the bank privacy they have had. Those numbered accounts are a different thing. They don't earn interest, and if you loose the number or the pass phrase, the money is lost. There's no other way to get to your money. There's no personal identifier stored with the account number. It is true that a lot criminals, dictators and intelligence agencies have used these accounts. And Swiss banks are quite happy to continue lending out that money if it is lost and never withdrawn. Dictator gets shot? Well that money is staying in the Swiss bank forever. Historically Swiss banks have been pretty solid, it used to be that they held 30% in reserves (that could have changed in the 90s). Tiny Switzerland has always known they weren't going to change the world on their own, they structured their country just to keep its citizens safe while the rest of Europe fought with itself in endless Rothschild funded wars. The Swiss being masters of dairy products merely skimmed a bit of the money milk as cream for themselves through anonymous accounts.

But Swiss accounts are kind of passe, with the IRS leveraging the Swiss banks so hard to release information on US tax cheats. UBS turned states evidence with US authorities and squealed on its private banking clients in exchange for a low publicity legal settlement. After all Swiss banks have a lot invested in the USA. They don't want that nationalized or confiscated. Customer loyalty only goes so far.

The real clever crooks keep their money in Caribbean banks, Panama, Seychelles or other banking havens of anonymity. Let's say you're a ruthless cut throat corporate magnate who has stashed a lot of cash over the years in a Panamanian bank. Maybe from all that war profiteering from no bid supply contracts for the Iraq war? You know the kind, bid it like its an American Union Electrician, then go hire a Bangladesh Electrician for pennies on the dollar to do the actual work. Meanwhile US Troops get electrified in showers from unsafe electrical wiring.

In the recent GATT free trade treaty with Panama, Congress put in a provision that prevents the USA from forcing Panamanian banks to disclose their US clients. This is enforced with WTO rules. And you thought GATT treaties were only about free trade! Your typical rogue corporate magnate doesn't want to live in Panama forever, they after all use US dollars as their currency and there's some crime there, even thieves don't like being robbed. This is about take the money and run. Maybe he's got to move it a domicile like the Dominican Republic or Paraguay, and the USA might be able to pick up the money trail there. What to do? Well they renounce their US citizenship! They're free of IRS jurisdiction and then they wire the money where they want. They're free to go to that Paraguay, Costa Rica, Macao or Dominican Republic estate, . Even those on the run like to live in style. Preferably in a warm climate.

There's many countries on earth where they can buy a passport legally for $25,000, and you can even get them for a few million of investment in a local business of a fairly advanced country. Paltry change to some of these guys, yet more than you and I will make in our life. Even the USA, 20 years ago you could get a US passport if a foreigner invested $250,000. That was not widely known. Is it any surprise America became a den of thieves?

Home

»

Graphs

»

US Citizens Renouncing Citizenship. US Expatriation

» The Rise in US Citizens Renouncing Their Citizenship by Quarter

Đăng ký:

Đăng Nhận xét (Atom)

0 nhận xét:

Đăng nhận xét